Services

Budgeting, Cash flow, and Business Planning

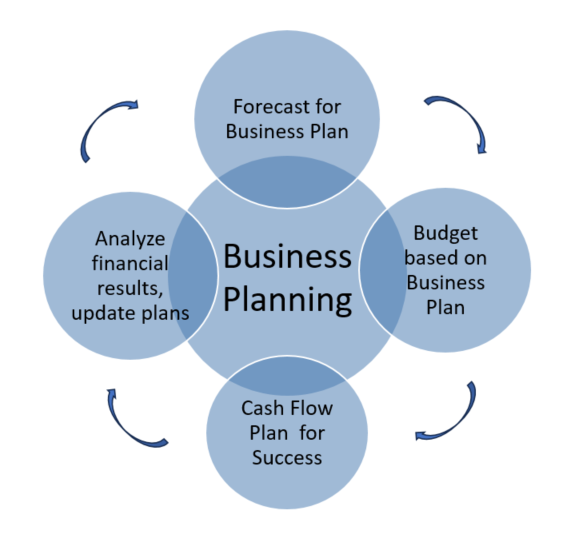

Business planning, budgeting, and cashflow forecasting are intricate, multi-step processes. They are the tools you need to define and chart your financial objectives, ensuring that you always have the necessary liquidity to meet your financial obligations as they arise. This essential financial journey plays a pivotal role in establishing your business’s credibility with financial institutions, attracting investors, securing favorable credit terms with suppliers, and fostering trust among your valued customers.

Budgeting and Cash flow Services

We at Business360 CPA can help you navigate your way through the budgeting and cash flow planning process, so you are ready to hit the road running with confidence to grow your business and build credibility by hitting revenue targets and paying your bills on time. Our services include:

Help identify all the costs associated with ongoing fixed operating cost or investment in new equipment, expansion costs or special projects for your business.

Determine the timing of cash payments for these fixed and special purpose expenditures.

Assist with revenue projections, levels of accounts receivable, and timing these revenue streams will be turned into real cash.

Based on revenue projections, determine the variable costs associated with delivering your products/services and the timing when expenses must actually be paid for with real cash.

Set up your accounts receivable system to monitor timing of payments and support collection activities where necessary.

Set up your accounts payable system to manage your account payments to maximize your available cash and pay bills on time, and enable negotiation of extension of terms or alternate financing when necessary to stay in good standing,

Building financial budget projections and cash flow projections you can use;

- in your business plan,

- to manage day-to-day operations

- manage the growth of your business, and

- to support a loan proposal.

Provide a comprehensive picture of the timing of cash coming in and cash going out expected time of cash shortfalls:

- to enable practical planning for such shortfalls, or

- force a change of plans.

Set up your accounting system, or implement necessary apps, so you can track actual revenue/expenses and cash flow relative to budget and cash flow projections so you can:

- Plan for expected cash shortages and manage them by obtaining a line of credit extension, bridge financing or other means of raising necessary cash to meet cash crunches.

- Invest excess cash when you have it.

- Correct course by adjusting operations in time to avoid cashflow problems and damage your business reputation.

- Modify budget and cashflow forecasts when real results indicate a need to change.

Business Planning Services

Effective business planning is vital to the success of your business. A business plan provides a roadmap, financial discipline, and the flexibility to adapt to changing conditions, ensuring your business stays on the path to growth and profitability.

Business Planning:

This step establishes a strategic framework for your business, typically spanning the next 2-5 years. It charts your path to growth and profitability.

Budgeting

Budgeting is the detailed, month-to-month implementation of your business plan, covering aspects such as revenue, expenses, cash flow, and debt management.

Cash Flow Planning

Cash flow planning involves tracking and constant comparison with actual results. It extends beyond sales and expenses to encompass accounts receivable, accounts payable, debt repayment, tax payments, and more.

Results Analysis:

Analyzing financial results is pivotal. It hinges on accurate accounting and data analysis both internally and externally. Changing financial results or market conditions, necessitate corresponding changes in plans.

Forecasting

Forecasting relies on historical data, market trends, statistics, and assumptions to predict future outcomes. These predictions guide adjustments for upcoming business cycles.

Request Your Consultation

Are you an individual, business, or both? Take control of your financial future, and schedule a free consultation with our expert CPAs today.

Alternatively, you can also fill in the form below: